The Criminal Finances Act - Guide for Businesses

Since 30 September 2017 it has been possible for companies and partnerships to face prosecution for facilitating tax evasion. Tax evasion and the facilitation of tax evasion are already criminal offences; however, it had historically been difficult to attribute criminal liability to a corporation where such instances occur. Since these rules were introduced, it is the corporate that will be subject to prosecution without the need for prosecution of any individual with successful prosecutions potentially leading to unlimited fines, public record of the conviction and significant reputational damage.

All businesses which are not sole traders should have a policy in place. Failure to do so can result in:

- An unlimited fine,

- Public Record of the conviction and

- Significant reputational damage and adverse publicity.

Our downloadable guide sets out the scope of the new offence and explains the practical steps that businesses should consider taking to protect themselves against criminal liability.

Which types of businesses can be prosecuted for facilitating tax evasion?

All companies and partnerships, regardless of size and sector are liable. While risk of prosecution rests firmly on the business, it is the actions of ‘associated persons’ that will trigger the events leading to a corporate criminal offence (CCO). Associated persons are any person (individual or corporate) who provides services for or on behalf of a business such as employees, contractors and agents.

The Offences

A business will be guilty of an offence if an associated person commits a UK tax evasion facilitation offence. A tax evasion facilitation offence consists of any of the following:

- Stage 1 Criminal tax evasion by a taxpayer under existing law.

- Stage 2 Criminal facilitation of this offence by an “associated person” of the corporation i.e. anyone who performs services for or on behalf of the business.

- Stage 3 The corporation failed to prevent its representative from committing the criminal act at Stage 2.

There does not need to be a conviction for either Stage 1 or Stage 2 for the third stage to apply and the legislation applies to evasion of both UK taxes and non-UK taxes where there is a UK aspect.

The law does give the organisation involved the defence that it had reasonable procedures in place to prevent the Stage 2 action, or that it was not reasonable for that organisation to have procedures in the first place.

MHA’s Offering

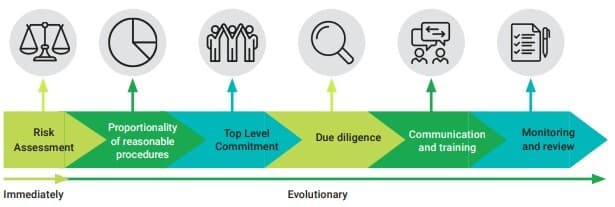

Our offering is based on HMRCs 6 Guiding Principles as outlined below, with a view to supporting businesses to put reasonable procedures in place and thus creating a robust defence.

In our experience, support is usually required towards the immediate and early part of the evolutionary process but we can support across the whole range. Our offerings can therefore be summarised as:

- CCO Risk Assessment Toolkit

Aimed primarily at lower risk SMEs, our CCO Risk Assessment Toolkit is a low-cost solution designed to give you the tools needed to start building your own CCO response. - CCO Risk Assessment Toolkit with Workshop

Aimed at low-medium risk SMEs and larger corporates, our CCO Risk Assessment Toolkit with Workshop option is a cost effective option designed to provide your organisation with the tools needed to assess the risks and build a defence to the CCO legislation. - Bespoke advice recommended for higher risk sectors and clients

This can include full support in implementing HMRC's 6 Guiding Principles, as well as creating policies and communicating to external stakeholders.

Conclusion

The Criminal Finances Act brings this entirely new criminal offence for all businesses which are not sole traders.

The Government has confirmed that they do not want to hinder how industry works but rather put in place a revised culture, which will lead to making tax evasion, like bribery, a thing of the past. Whilst the rules will be policed with a gentle touch initially, it is expected in the fullness of time that prosecutions will arise where not only the financial cost could be high but so will the reputational risks as well.

Download our Focus On: Corporate Criminal Offences

Focus On: Corporate Criminal Offences

Contact us

Our team is used to assessing risk and is ready to help you start the process of understanding where the risks lie in your organisation and then assist in providing solutions